Why Fundamental Models in Great Britain Need Flow Based Market Coupling

Recent extreme market shocks have resulted in significant volatility in European power markets. Some of which included fuel price shocks due to the...

2 min read

-1.png) Dimitris Giotis

:

September 26, 2021

Dimitris Giotis

:

September 26, 2021

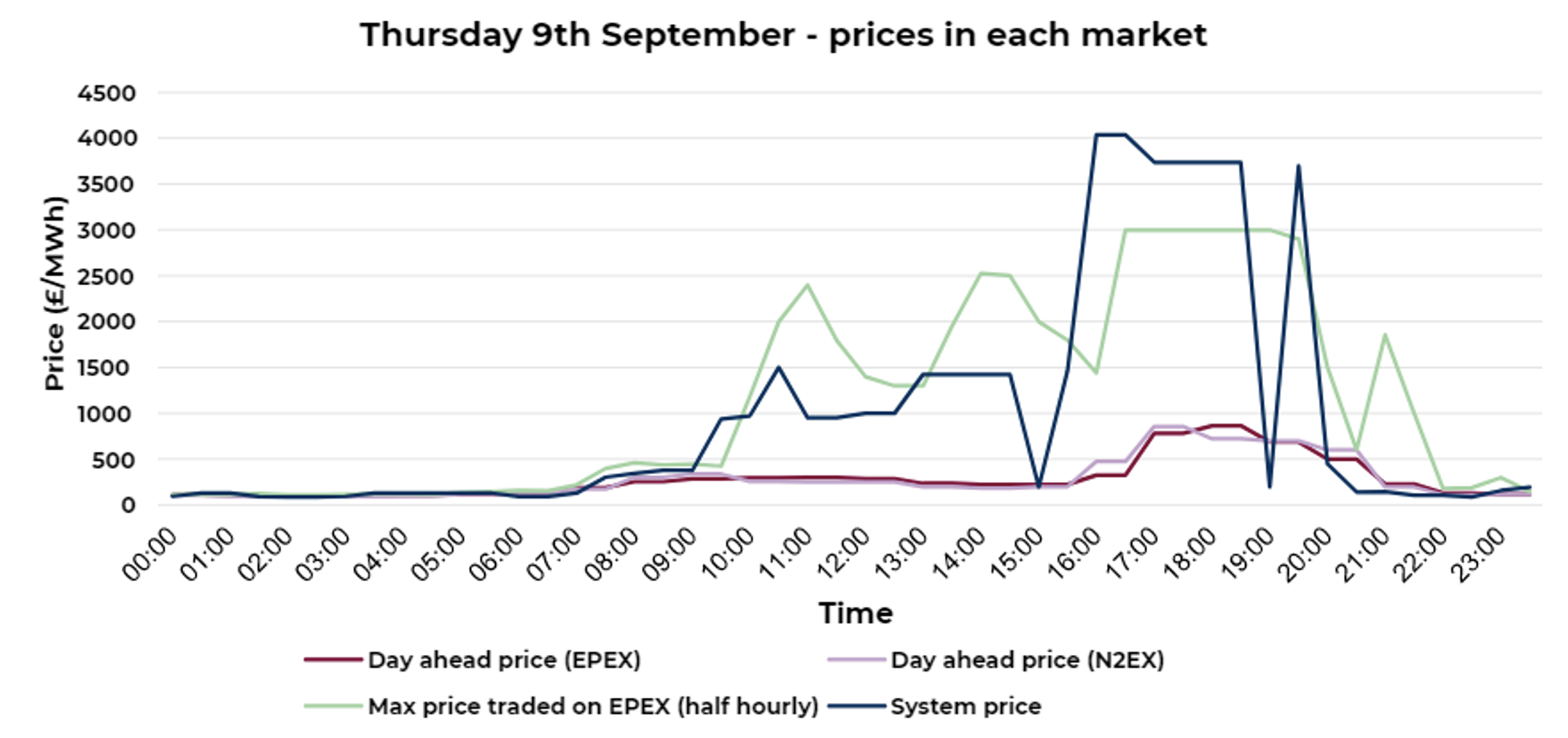

On the 16th of September 2021, the day-ahead prices in Great Britain climbed as high as £1,860/MWh (maximum day-ahead price in September last year was around £205/MWh). This came as the latest episode in a series of events that will have a knock-on effect on the wholesale price in Great Britain in the winter and, subsequently, on the consumers. A few days ago, on the 9th of September, the day-ahead prices rose to £867/MWh, while the within-day price on EPEX reached £3000/MWh. The following graph presents the prices in GB on the 9th of September in each market.

Source: lcp.uk.com

The pricing fluctuation can be understood in the following points:

Great Britain's market is currently in the middle of several events that have sparked concerns that the country will face the possibility of not maintaining the security of supply. The interconnectors were not fully importing, mainly due to Ireland's tight market conditions and the maintenance schedule on the 1GW IFA2 interconnector between France and GB. On Wednesday the 15th of September, the IFA1 interconnector between GB and France was on fire, resulting in the loss of 2GW of interconnection capacity and further tight capacity margin.

Additionally, wind resources are scarce, and the thermal capacity under maintenance is around 17GW, including the mothballed 1.7GW Calon assets of Sutton Bridge and Severn Power. These events have increased the demand for gas for electricity generation in GB, resulting in even higher spot and forward gas prices amid inadequate gas storage levels. For October 2021, the TTF price (Virtual Gas Trading hub in the Netherlands) has shown a record high of €79/MWh – an increase of 250% since January. Finally, carbon prices have climbed above €60/tCO2 as the EU reduces the supply of emission credits.

As a result, many flexible generators opted out of the wholesale market and instead participated in the balancing market. The National Grid had no choice but to accept the high pricing from generators. The 9th of September turned out to be the most expensive day of balancing actions ever, reaching a cost of £38mn.

This is the perfect storm for both Europe and Great Britain, both of whom are heavily reliant on interconnection and wind. Energy analysts warn of a brutal winter for Britain's capacity margin caused by high gas and carbon prices, the absence of wind, and high demand.

Under the current circumstances, the gas fired assets (especially the flexible ones such as OCGTs and Engines) take advantage of the low capacity margin and bid much higher than their SRMC aiming to capture as high spread as possible.

However, this perfect storm can be considered the ideal opportunity for PLEXOS to showcase its value to almost all market participants. For example, the flexible generation asset managers can model this perfect storm scenario and perform Monte-Carlo and Stochastic Optimization sensitivities to optimize the operation and unit commitment of their assets. PLEXOS can give the necessary insight regarding when to turn on and off the flexible assets, charge and discharge storage assets, and effectively advise the best strategy to realize greater value from trading operations.

Greece is a country with more than 200 islands dotting the Mediterranean Sea, of which many are inhabited and have mountainous terrain. As such, the...

Ren-Gas, Finnish P2X Project Development Company Ren-Gas is a Finland-based clean energy project developer. The company invests in the best...