Translate decarbonization targets into energy investment strategies

Accurately account for, and navigate decarbonization policies.

Globally, carbon policies are being implemented by local and national governments, and over the next five years most states will have implemented some level of carbon reduction policy.

Carbon being a free effluent is coming to an end. This is going to change the economics substantially on burning methane and utilities need to take carbon planning into account when planning long term investments.

Translating decarbonization targets and potential carbon markets can be complex and intimidating, especially when translating these policies into organizational strategies and integrated resource plans (IRPs). How do utilities account for these policy changes when working with regulators? How can costs be kept down to best serve end customers?

Accurately accounting for, and navigating, decarbonization policies will be one of the greatest challenges gas utilities will face over the next two decades.

PLEXOS allows organizations to assess levels of risk, analyze policy impacts, and plan future investments with ultra-high-definition modeling capabilities encompassing electric distribution, water, and gas supply chains. This holistic approach enables organizations to invest with confidence while navigating changes in gas demand, decarbonization targets, market options (carbon credits, trading or offsets), and changing technologies.

PLEXOS provides critical planning insights to utilities around the world such as:

- How much carbon do we produce without any mitigation?

- What is the cost of that carbon to the utility and our rate base?

- What are the best options to reduce our carbon footprint?

- What are the costs of various reduction options?

- Can we meet our state’s policies with available options?

Carbon Policy Planning with PLEXOS

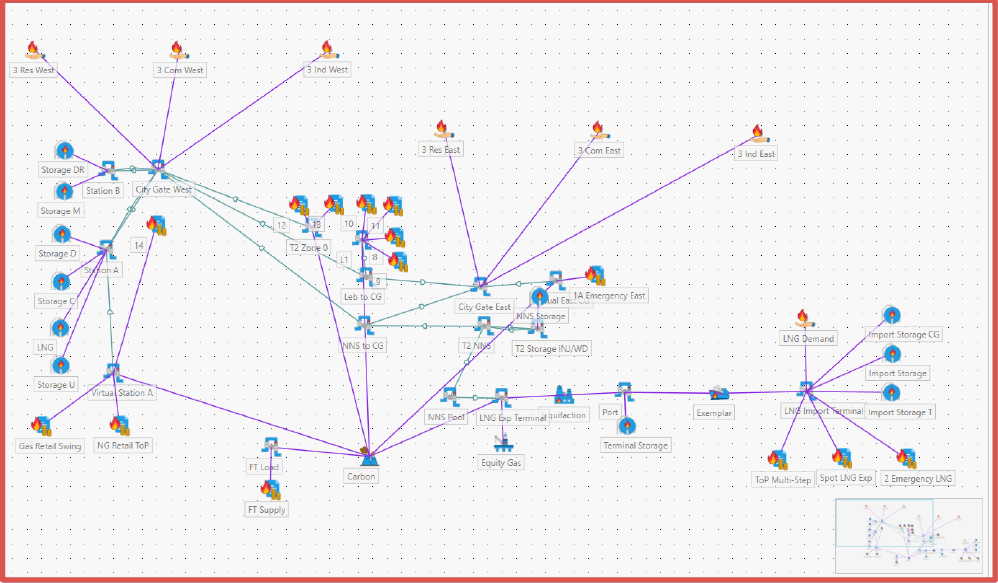

Let’s look at an example system in PLEXOS which will help us answer these questions.

Scenario 1: Base Case Model

PLEXOS begins by modeling all company assets in an organization’s portfolio including supply contracts, equity gas, pipelines, storages, and gas demand. In this example PLEXOS is modeling a typical gas Local Distribution Company (LDC). One key component that is new and is a starting point for most gas LDC’s is the introduction of the carbon emissions object. This object represents the costs and constraints and is connected to all gas supplies in the example system. This base system will now allow us to understand the base costs of emissions to the portfolio without layering any targets or constraints. This is our starting point.

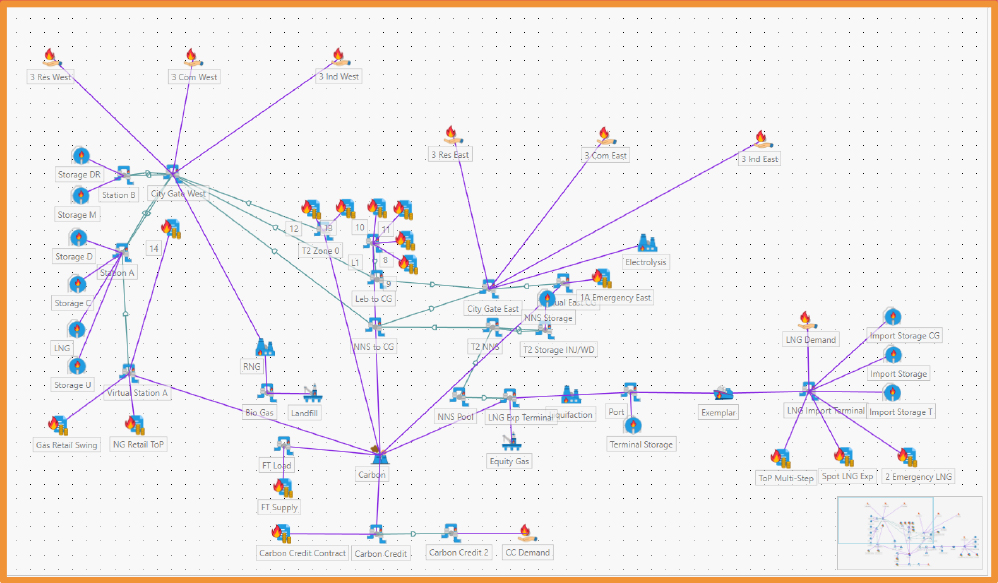

Scenario 2: Emission Constraints and Carbon Credits

When we introduce the emissions object in our base case all that was included is simply a $.01 / Ton cost; however, we need PLEXOS to tell us when the portfolio will no longer meet demand obligations when targets and emissions constraints are introduced. In this scenario constraints, a carbon credit market as well as some alternatives such as a biofuel plant and electrolysis facility are added. This scenario will allow PLEXOS to meet demand obligations and emissions standards by choosing lower or no carbon emissions build options.

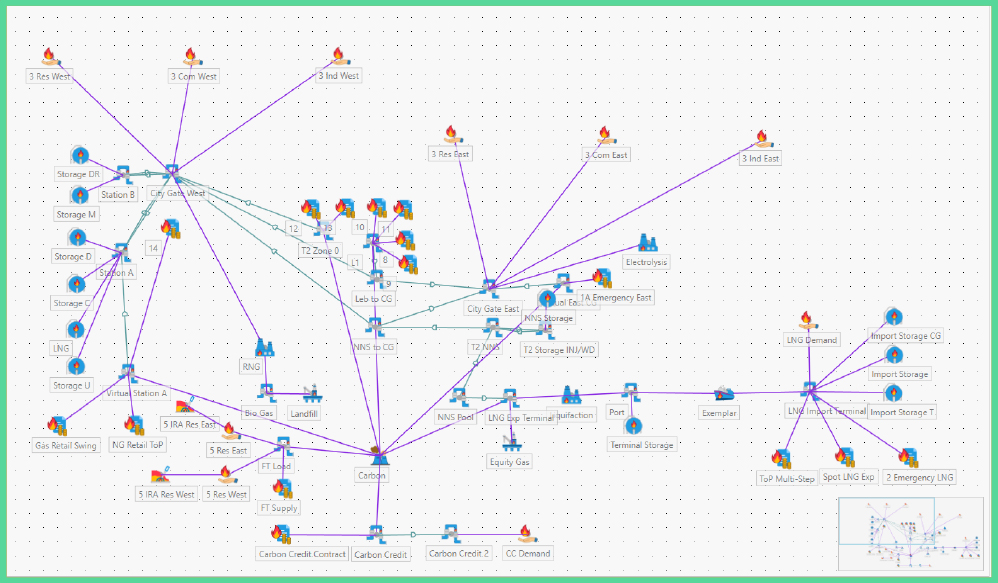

Scenario 3: Demand Reduction

Lastly we introduce two demand side reduction options to replicate various inflation reduction act incentives. These demand side management strategies assume no cost to the utility due to federal funding and show incremental demand reduction through the study horizon.

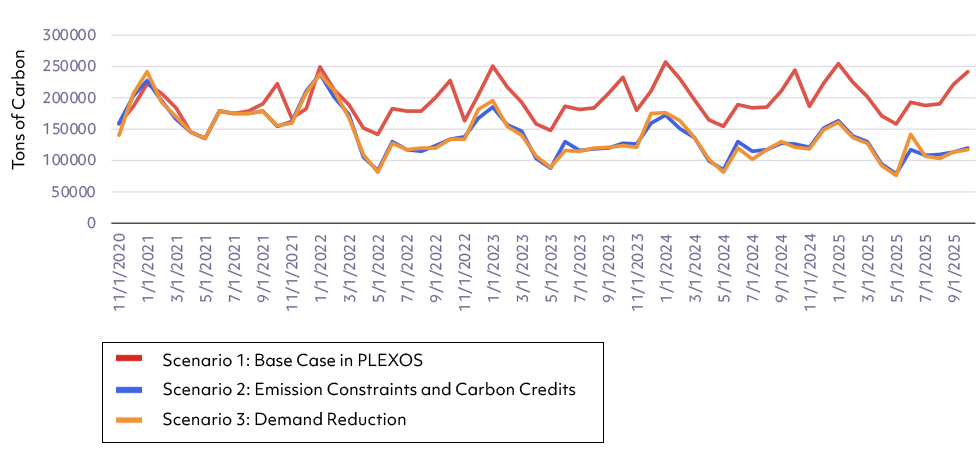

Emission Insights with PLEXOS

Hit your Emission Targets

As we review the various scenarios we start by reviewing total carbon production, the red line shows our base case that has no emissions targets and simply accounts for carbon production, in the other two scenarios we see incremental yearly targets with decreased allowed carbon production that both follow the expected annual caps.

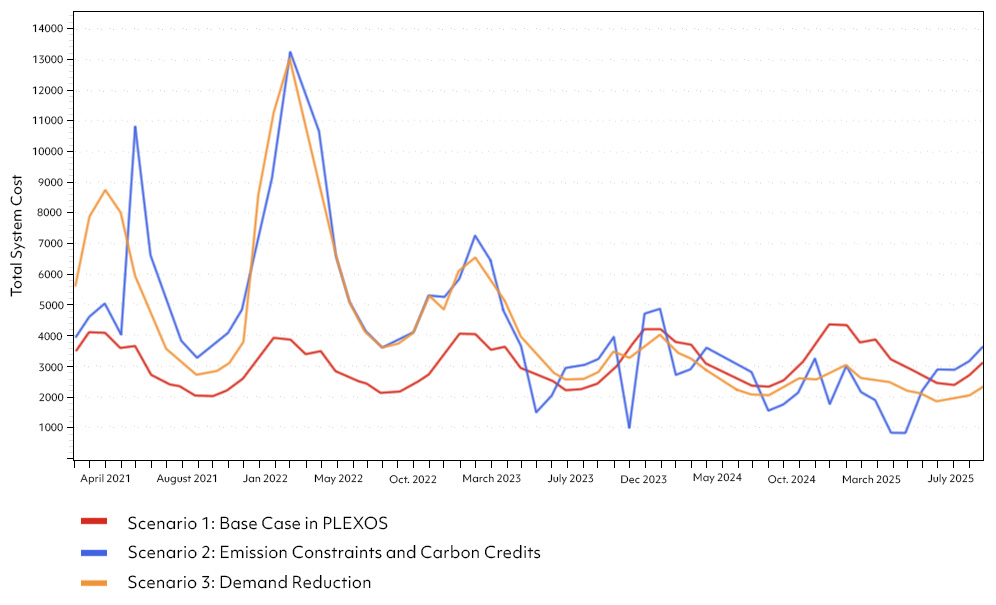

Analyze Total System Costs

When we look at the total system costs we can see that the earlier years as we bring newer technologies online is causing much higher prices. We are also having to pay for carbon emissions before we have many mitigation strategies in place.

Looking forward a few years model results show emissions are mitigated and the total system costs are coming down substantially.

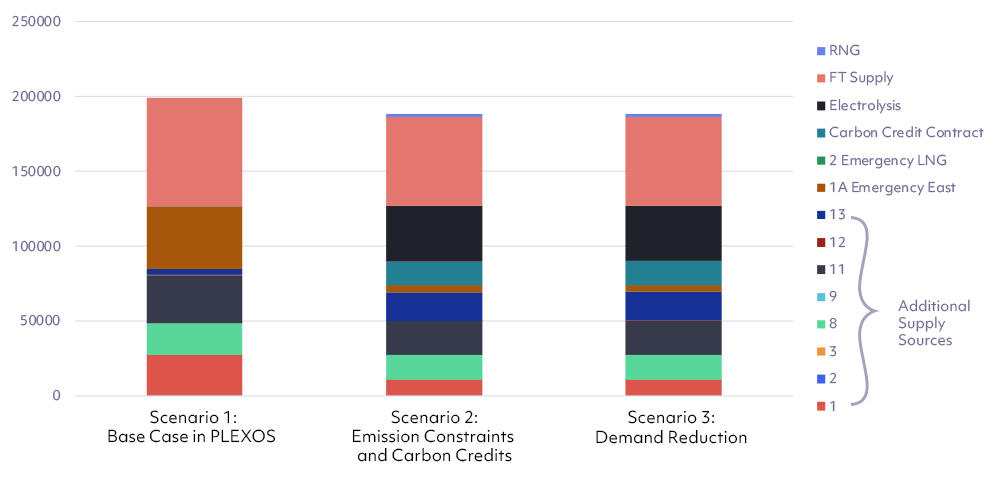

Understand Impacts on Supply Dispatch

Each of the scenarios here shows how our supply dispatch changes when emissions constraints and alternatives low carbon producing supplies are allowed. With carbon targets added and options to take lower emissions options the two scenarios take substantially more hydrogen and RNG, with RNG mostly impacted by the demand side management plans coming in as alternatives on the DSM scenario. The other area that allows for meeting both demand and carbon targets is the carbon credits.

-1.png?width=854&height=504&name=Energy%20Exemplar%20Logo%20Black%20(2)-1.png)