Price Forecasting

Accurate energy market price forecasting is critical for energy producers, consumers, and investors to mitigate risk and navigate evolving markets. As decarbonization reshapes grid dynamics - introducing trends like negative pricing - simulation solutions like the PLEXOS® platform help make sense of the complexity. Watch the video to see how PLEXOS models real-world generator behavior, transmission constraints, and market fundamentals.

How market prices are formed in real-world systems

Energy generators provide bids to the market which consist of the volume of energy they are able to provide along with the cost of providing that energy. At the same time, consumers – industrial consumers and energy retailers – calculate how much energy they are expecting to need and how much they are willing to pay for it. Market operators function as the clearing house for matching bids for supply and demand, setting energy prices and managing the operation of the grid. In most cases, market operators stack the bids from energy generators and consumers to align the two sets of bids. The price of energy naturally falls out where the price consumers are willing to pay overlaps with the price of the most expensive units of electricity being consumed.

How PLEXOS models short- and long-term energy prices

Accurately forecasting energy pricing with PLEXOS across any time interval from minutes to hours enables Energy Exemplar clients to invest and plan with confidence.

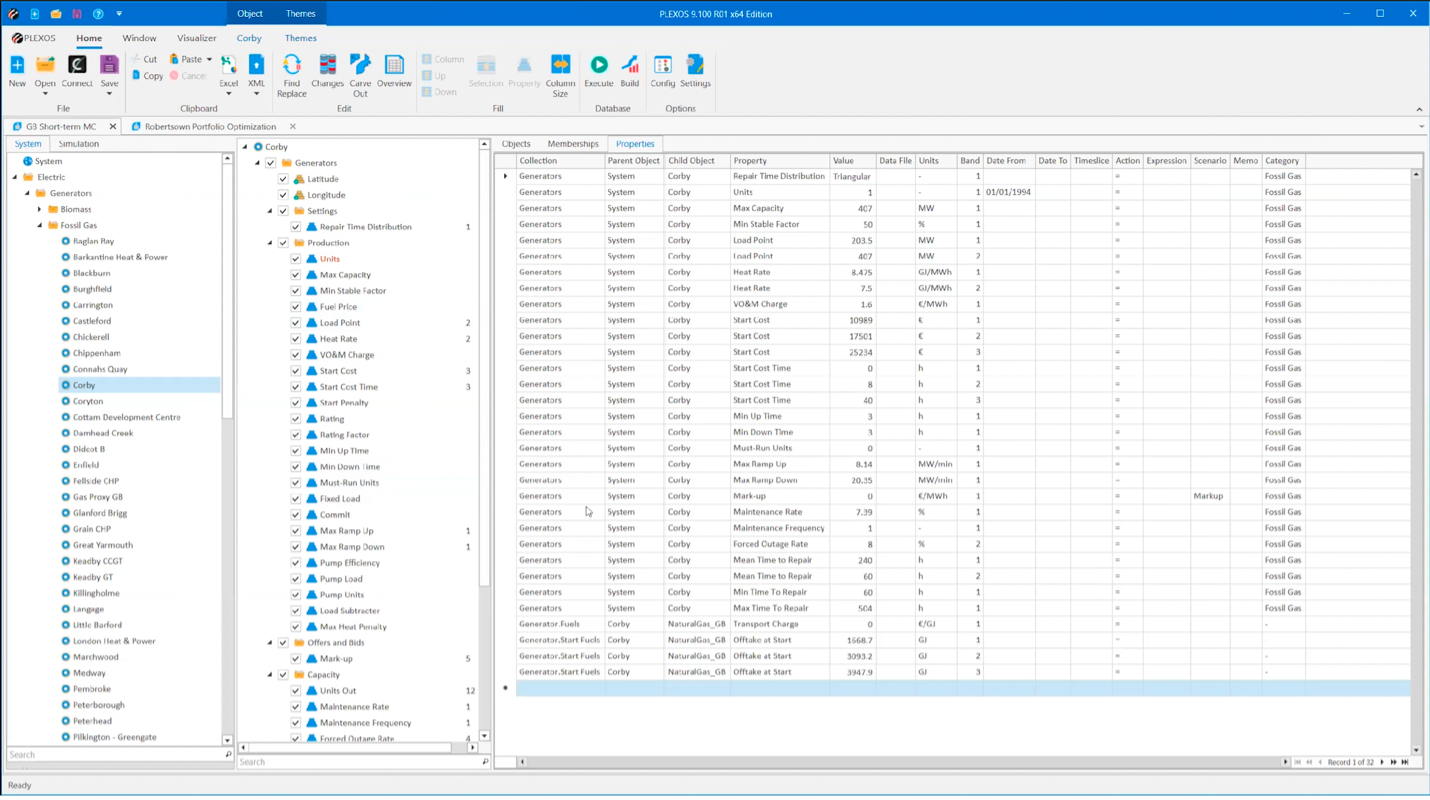

Using the UK market as an example, PLEXOS models every generator so that at minimum they recover their operating cost and then determines the minimum bid price of a generator asset by factoring in operating costs, the volume of electricity each generator can offer, and constraints on the flexibility of the generator to ramp. For example, a coal power generator must stay online for an extended period of time and cannot start quickly to meet high demand for a single hour. Technical limitations such as this are considered to understand the amount of energy that a generator can produce at any given point in time.

Energy Exemplar’s simulation ready datasets make it easy to get started with PLEXOS. Datasets contain all underlining “seed data”, needed to model the power system including technical and economic representations of every component in the power system, from transmission line capacity to individual characteristics of every generator on the grid.

Accurately model every generator’s cost per megawatt of electricity and other economic parameters such as maintenance costs, emissions costs, and other information to estimate likely bid prices from generators. Factors such as minimum up time, minimum down time, ramping capabilities are also available to model constraints on how individual generation units are able to operate and the volume of energy each generator can produce on an an hourly and sub-hourly basis.

These details enable PLEXOS to generate bid prices to provide a proxy of likely bids that will be on the market.

On the demand side, PLEXOS provides some regional demand scenarios but leaves it up to end users to provide more granular information to account for different scenarios, such as extreme weather events, fluctuating fuel prices, or increased intermittent renewable generation to name a few market conditions that may be examined.

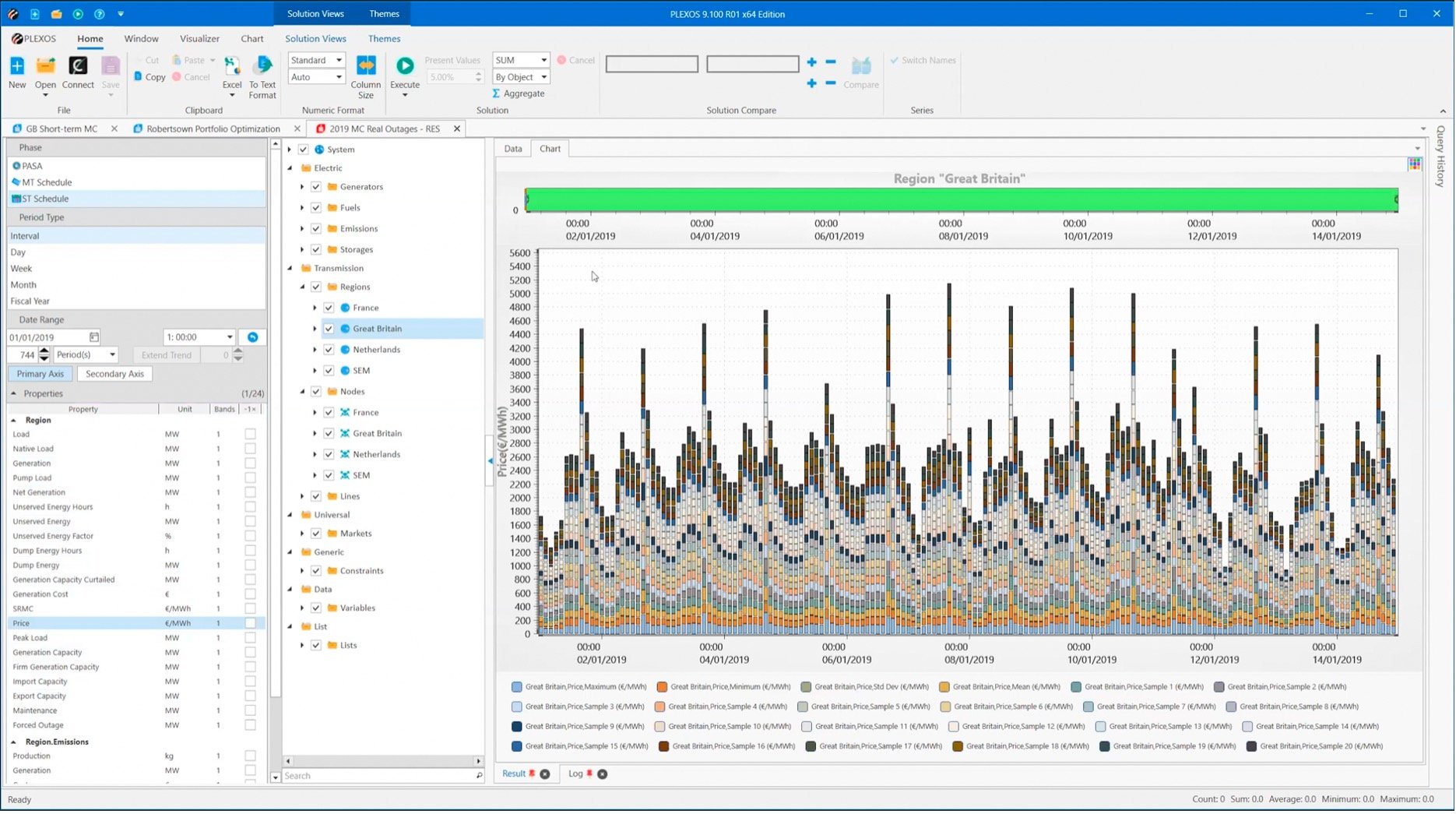

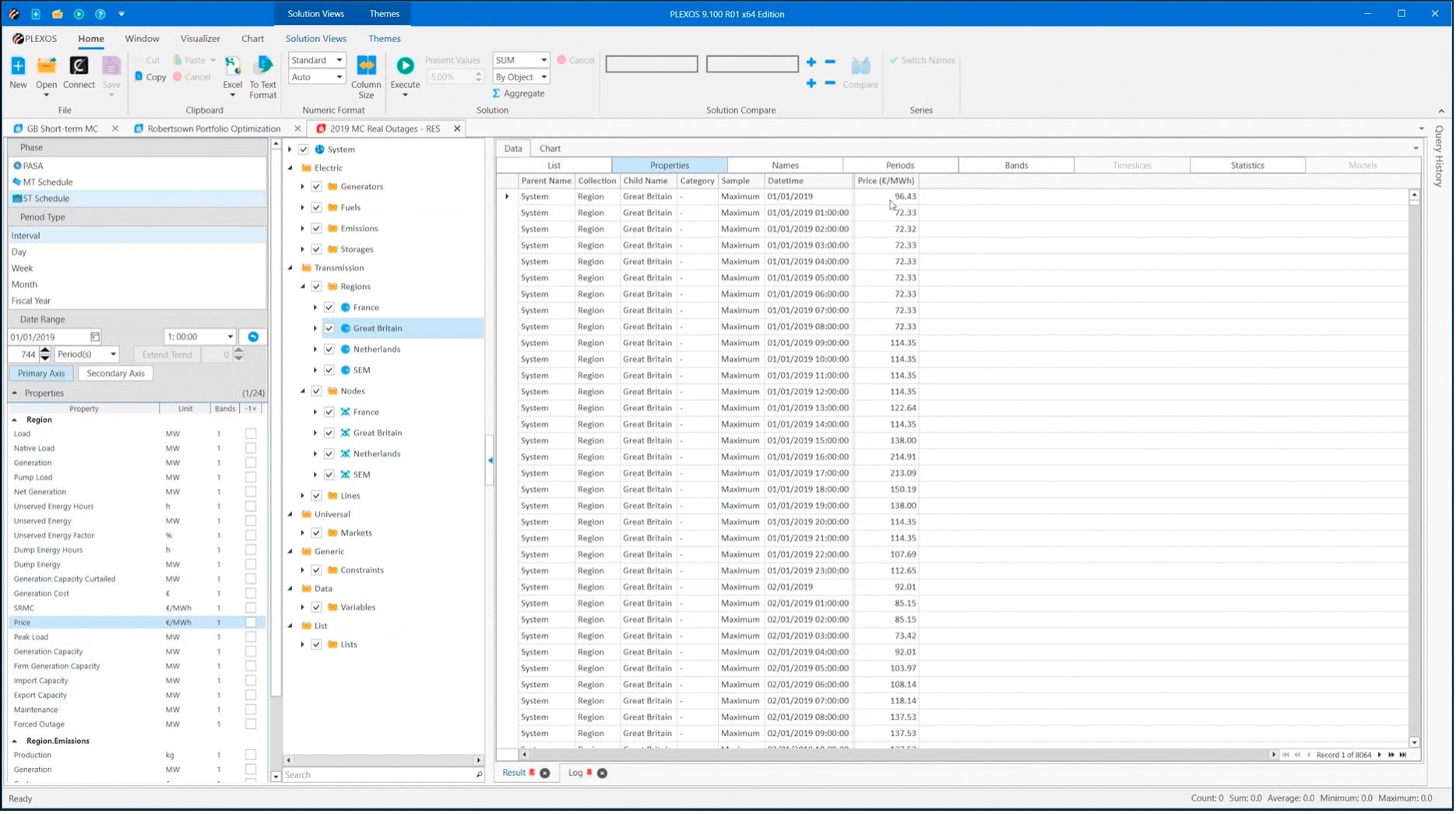

After configuring the scenario, you wish to examine, PLEXOS emulates the principles of the market by meeting demand and required reserve capacity at least cost. Configure and analyze any market time step from hourly, to five-minute increments, and across any time horizon from very short-term horizons to thirty years. Examine market prices at different regions and points across the grid.

Price can be viewed in both table and chart formats to simplify presenting data to stakeholders.