Introducing PLEXOS 10 and the PLEXOS Platform

PLEXOS has evolved – It’s not a Tool, it's a Platform The launch of PLEXOS 10 marks the beginning of an era. PLEXOS 10 introduces new products,...

6 min read

Tracey Granger, Rob Homer & Evgeniia Kirillova : Dec 19, 2023 10:07:51 AM

The significance of co-optimized energy solutions has never been more critical, as we are reaching a time where energy efficiency and sustainability are no longer luxuries but necessities. The last few years have shown the energy industry that all commodities can become volatile, experiencing a wide range of unprecedented market highs. As we continue to face a global energy transition, the traditional separation of energy markets – electricity, gas, and the emerging hydrogen sector – poses significant challenges to and missed opportunities for security of supply and efficiency through an integrated approach. This is where the concept of co-optimization becomes not just relevant, but essential.

According to the U.S. Energy Information Administration (EIA), global energy consumption is projected to increase by nearly 50% by 2050. Renewable technologies and disruptive zero-carbon-energy innovations are challenging conventional, established energy systems, and current supply-demand energy mixes. Along with the increasing volatility of energy prices impacting economies worldwide, there's a pressing need for innovative solutions that can effectively integrate different energy sources while optimizing their use and cost. The need for integrated energy solutions is not just a technological imperative; it's a challenge that directly affects every energy consumer, from large industries to individual households.

At Energy Exemplar, we understand this urgency and the potential of our PLEXOS Co-optimized Dataset in transforming how energy is modeled, valued, and understood. Our passion for energy planning is matched by our commitment to aiding the energy transition. This transition requires a whole new way of thinking about energy – a synergy between new and old energy sources and technologies, operated and interconnected in innovative ways. We aim to stay at the forefront of these changes, and equip our clients with tools to model, value and better understand these emerging paradigms.

PLEXOS Co-optimized Datasets in Europe: A Game-Changer for Energy Modeling

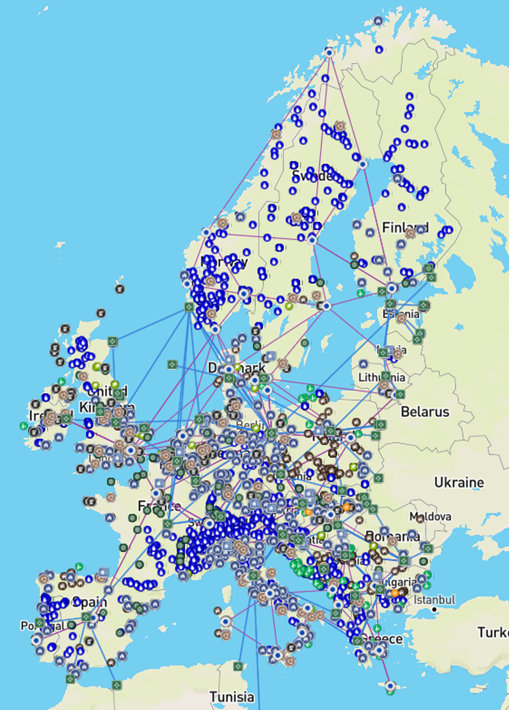

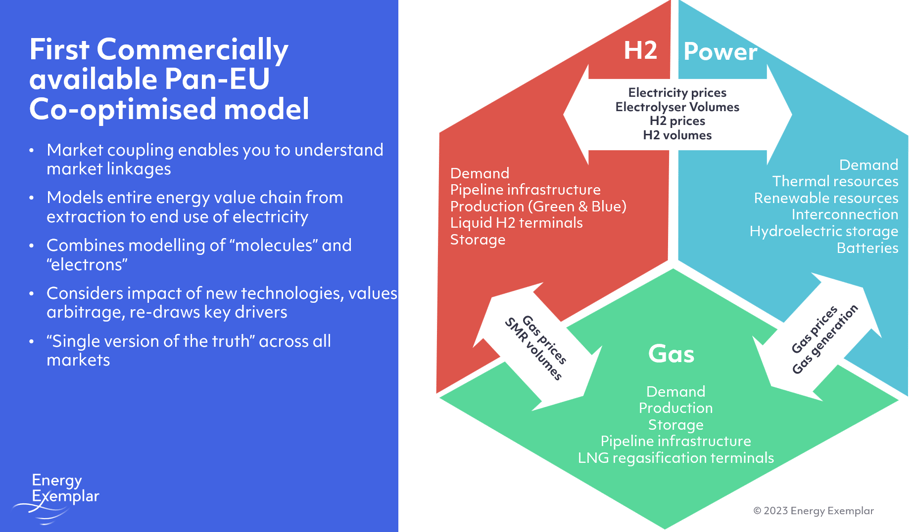

Our first PLEXOS Co-optimized Dataset covers electricity, hydrogen and gas markets in a single PLEXOS model across the whole of Europe. PLEXOS users have long been able to model linkages between markets using the co-optimization functionality of PLEXOS Electricity and PLEXOS Gas modules; but this is the first time we have released the comprehensive pan-European PLEXOS Co-optimized Dataset to support that modeling effort. The use of multi-fuel energy modeling provides users with the ability to incorporate a diverse range of resources into their projections of future energy infrastructure and develop a nuanced examination of the power generation mix. By integrating multiple fuel types, stakeholders can create a comprehensive and elegant representation of the complex dynamics shaping the future energy construction landscape.

With the release of Energy Exemplar’s PLEXOS Co-optimized Dataset in Europe, users can now model the entire energy value chain from the extraction, production and transportation of natural gas and hydrogen through to the end use of electricity from now to 2050. The dataset includes the first ever fundamental analysis of the European hydrogen system as it becomes a vital component of the energy mix. No other energy planning tool provider offers a fully integrated power, gas, and hydrogen dataset – the PLEXOS Co-optimized Dataset provides the results across all markets and time horizons in a single model run. Our sophisticated approach enables detailed analysis of the power generation mix, looking closely at key factors such as natural gas and hydrogen consumption.

European PLEXOS Co-optimized Dataset (Source: PLEXOS Cloud)

The need for a co-optimized approach

Natural gas and hydrogen are an integral part of the evolving energy transition, offering cleaner alternatives to traditional fossil fuels. Understanding their compatibility, synergies and potential trade-offs is critical to optimizing the overall environmental impact of energy production and consumption. The variability of energy demand and the intermittency of renewable energy sources require a diversified energy mix.

Traditionally, energy markets have been modeled separately – gas molecules modeled apart from electrons. Separate transmission operators, market structures and, in most countries, ownership structures have entrenched the division. The gas market has emerged largely from the global oil industry; the electricity market from localized utility structures. In Europe, this division is exacerbated by the convention of modeling electricity in lower heating value (LHV or net calorific value) terms, and gas in higher heating value (HHV or gross calorific value). Until recently, this hasn’t proven to be too much of an issue: the concept of a “clean spark spread” has emerged, and liquid gas hub markets and prices have enabled gas generation to be efficiently priced without much need for a full appreciation of gas dynamics.

However, the emergence of the hydrogen market has changed all that.

Hydrogen is, by definition, molecular; so hydrogen volumes and energy content need to be accounted for during modeling. Modeling hydrogen as a simple “sink market” for surplus renewable electrical energy is not sufficient. It fails to capture the complex hourly inter-dynamics of green and blue hydrogen production, the marginal cost of hydrogen production, and the future impact of hydrogen-based seasonal storage on the electricity (and gas) market.

The continuing globalization of the gas market through the growing LNG trade has also reinforced the linkages between different energy-based commodities.

Europe is increasingly looking externally for gas supplies; LNG growth as part of the gas supply mix has been accelerated as a replacement for Russian gas. This makes gas prices increasingly sensitive to the global LNG market and European storage levels – which are, in turn, impacted by gas generation volumes. As gas plants are flexible “price making” rather than “price taking” assets, like most of the plants across Europe, any gas price change will have a significant impact on the marginal electricity price and gas burn. This was amply demonstrated during Winter 2022/23 when the potential for gas supply shortages sent electricity prices sky-rocketing across Europe, and gas storage volumes plummeted. Market dynamics remain vulnerable to changes in the global market. Such is the fragility of the market that even a subtle hint of a plausible supply disruption due to infrastructure constraints or labor strikes at liquefied natural gas facilities in distant locations has the potential to trigger price volatility. The prevailing calm belies the underlying fragility, with market movements closely intertwined with global factors, highlighting the need for vigilance and adaptability in navigating the current economic landscape.

Modeling a diversified energy mix of gas and hydrogen, in addition to the power generation supply mix, provides a strategic hedge against supply disruptions and market volatility. It also promotes energy security by reducing dependence on a single energy source or supplier.

An essential and notable facet of this modeling approach is its ability to provide a comprehensive picture of the energy infrastructure required to meet future climate targets. “Picking winners” in an investment context requires a detailed understanding of the linkages underpinning the entire energy framework, including transmission pipelines in line with demand projections, gas and hydrogen storage capacity and battery storage are also of paramount importance. Forecasting gas generation will be further complicated by the decision of whether to burn (or blend) hydrogen and/or gas to meet emissions targets and support low-wind periods: to model this requires a coordinated view of hydrogen, gas and electricity markets so that the complex marginal dynamics are taken into account.

In other words, relying on an externally generated gas, electricity and/or hydrogen price or volume to model volume and price trends and volatility is insufficient: a full understanding of the interaction between gas, hydrogen and electricity market dynamics is required.

Summary of modeling components and market linkages in PLEXOS Co-optimized Dataset

Discover Energy Exemplar’s PLEXOS Co-optimized Dataset

Gain access to our PLEXOS Co-optimized Dataset and see how PLEXOS models the linkages between electricity, gas and hydrogen markets.

PLEXOS has evolved – It’s not a Tool, it's a Platform The launch of PLEXOS 10 marks the beginning of an era. PLEXOS 10 introduces new products,...

Each month, we highlight the latest enhancements made across the PLEXOS® platform to help you model faster, plan smarter, and collaborate more...

Each month, we highlight the latest enhancements across the PLEXOS® platform to help you model faster, plan smarter, and collaborate more...