European Hydrogen Storage: Key to Enhancing Energy System Adequacy and Security in PLEXOS

This blog is part of a series on hydrogen in PLEXOS, following our discussion on hydrogen transport modelling, which can be found here.

3 min read

Rob Homer

:

Dec 8, 2023 10:00:37 AM

Rob Homer

:

Dec 8, 2023 10:00:37 AM

As Europe positions itself for a significant transformation in energy paradigms, a critical question emerges: How will Europe meet strict carbon targets while ensuring reliable energy production for years to come?

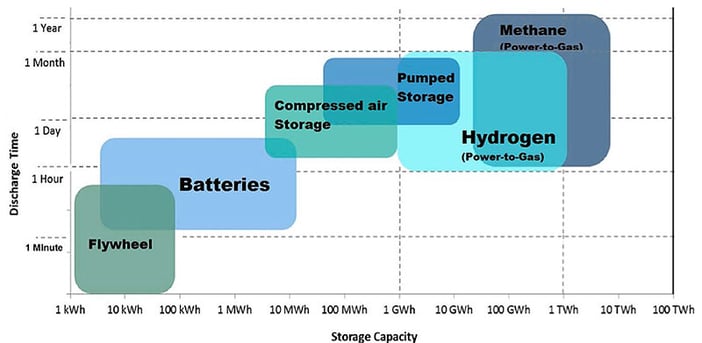

Numerous suggested approaches focus on using renewable energy and large-scale battery storage to meet resource and energy sufficiency requirements. Incorporating long-duration energy storage can notably diminish the investment costs associated with these strategies. This reduction is achieved by lessening the reliance on volatile markets often resulting from these strategies. Presently, methane serves as a form of long-term energy storage. However, with impending net zero carbon mandates, the development of new technologies becomes essential.

The answer to this requirement is leaning towards an innovative solution – the expanding hydrogen marketplace. Green and blue hydrogen are long-term storage solutions which may fill the need for long-duration storage, while also adding robustness for reliability during seasonal extremes.

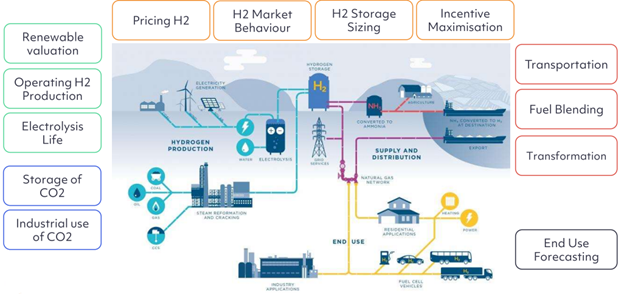

In this article, we explore how hydrogen can facilitate the shift from traditional fossil fuels to cleaner energy sources, its role in transforming energy storage solutions, and its effects on industries aiming to reduce carbon emissions. Additionally, we highlight Energy Exemplar’s new, one-of-a-kind European Hydrogen Dataset, which provides valuable information on hydrogen production, transportation, and market economics, supporting informed decision-making in this field.

Energy Storage

With the increase of intermittent renewable assets, energy storage has become a major topic of conversation. Battery technologies have accelerated through the past decade for a variety of reasons, including advances in electric vehicles and integration of intermittent renewable generation. However, long term energy storage has been the domain of coal stockpiles, underground seasonal methane storage, and hydropower. Two of those three directly contribute to CO2 emissions, while the third is not universally feasible at the scale required. Hydrogen (and derivatives) appear to be capable of satisfying most of the requirements of long-duration storage - potentially without the carbon impacts.

Hydrogen may also play a role in decarbonizing energy-intensive industries like steel, mining and mineral, in addition to other areas that have shown less natural affinity to decarbonization. When these industries plan pathways to decarbonization, both long and short duration energy storage are part of the planned solution to minimize the Levelized Cost of X (LCOX) where X is their primary commodity. The ability to shift energy production seasonally can make a significant difference when maximizing production with a specified level of investment.

The instability in Europe's methane supply has revealed significant economic challenges, including high expenses, supply deficits, and considerable impacts on GDP during shortages. Western Europe is actively seeking alternatives to conventional methane, with hydrogen emerging as a prominent option. Its ability to replace methane’s long-term storage capabilities without necessarily requiring any carbon production is an advantage that many governments and business find beneficial. While there are many benefits, the inclusion of hydrogen at scale as part of the energy economy does create some structural changes that governments and businesses need to understand in order to invest confidently. Recognizing the need to navigate these structural changes and the uncertainties they bring, particularly in hydrogen transition, leads to the importance of effective planning and forecasting tools. This is where Energy Exemplar steps in with its European Hydrogen Dataset.

Energy Exemplar's European Hydrogen Dataset

Energy Exemplar recognizes the complexity of planning for a technology that is completely new with very little understanding of the future investment and growth. With the release of our European Hydrogen Dataset, PLEXOS can now provide sound insight into future investment, production, transportation, and price of green and blue hydrogen. The renowned fundamental modeling of PLEXOS combined with transparent, public input data provides a smooth path forward for analyzing the future of this otherwise uncertain market.

Our European Hydrogen Dataset allows you to gain a detailed perspective on the potential impact of the hydrogen market from 2030 to 2050. Developed with cutting-edge insights into the expected growth of the hydrogen sector across Europe, this dataset offers an in-depth analysis.

What's Included in the Dataset?

With the hydrogen dataset as the starting point, you don't need to do any of the legwork to find the input data and configure a rational model - we've done it for you. Time to value and insights is immediate.

Discover Hydrogen Energy with Our Dataset

Fill out the form below to speak to an expert about how to gain access to the European Hydrogen Dataset today and master the complexities of hydrogen energy.

Start planning with PLEXOS today

With an energy modeling platform that’s more customizable, more connected, and provides more insights than ever before. Learn more about PLEXOS and accompanying Datasets today!

This blog is part of a series on hydrogen in PLEXOS, following our discussion on hydrogen transport modelling, which can be found here.

1 min read

This blog is part of a series on our co-optimization models in PLEXOS, following our discussion on Embracing the Energy Transition with PLEXOS...