Technology

There are all types of combinations possible from fossil to wind and, the most common technology, solar.

The green energy transformation continues to accelerate. As new technologies and new solutions come online, new challenges arise. For example, in the next ten years, the United States expects to see a twelve thousand percent increase in electric vehicles. In 2021, almost 290 gigawatts (GW) of renewable power was commissioned, and over the next five years, renewable capacity growth is expected to account for nearly 95% of the increase in global power capacity. While Battery storage development continues to lag behind renewables, projects in key markets will accelerate the growth of battery storage from 5GW in 2020 to 600 GW capacity installed by 2030, according to the IEA.

With the rapid expansion of renewables and energy storage solutions, planning for energy generation and transmission has never been more complex. Making sound business decisions is no longer effective looking at generation or transmission as siloed studies. Organizations must analyze the impact a new facility will have on their entire portfolio. Battery storage is an especially interesting new technology as it also has the potential to impact transmission congestion, and ramping requirements at heat generation facilities, and many other impacts to the rest of a portfolio.

And accurately maximizing your returns requires a holistic and integrated view of the energy markets, including electricity, natural gas, water, transportation and heat. Planning new hybrid (renewable + storage) projects requires understanding how much energy can be absorbed into the existing electric grid, where they are need, how they should be configured and what the optimal sizing should be.

For example, generation models can help plan one aspect of a hybrid project. Those models that don't also consider transmission fail to show the value of a battery’s ability to decrease transmission congestion and increase the project’s effective load carrying capability (ELCC).

Only PLEXOS enables organizations to right-size hybrid resource investments by considering the entire energy market, including electricity, natural gas, transportation, and storage technologies.

In this use case, PLEXOS allows an organization to model the best ratio of energy storage to generation, while considering the six criteria listed below, to help determine the best hybrid configuration, maximize ROI, and determine how the hybrid resource should best be deployed (energy production, ramping, or congestion relief).

There are all types of combinations possible from fossil to wind and, the most common technology, solar.

The location will determine the value and risk an organization is taking on the project; that is why nodal analysis is so important. Understanding the site-specific distribution and transmission levels is critical.

It's important to understand the threshold at which returns of hybrid resources can diminish above a certain capacity. Bigger isn't necessarily better as there is an optimal ratio between energy generation and storage to maximize investment returns.

What type of commodities does the business offer and what other commodities should be included in the analysis.

How flexible are existing resources to new conditions or new products. Understanding how resources can adapt to new requirements is important.

Understand what vulnerabilities or mitigation factors are available to you. This is especially relevant when you have multiple generation assets in your portfolio, as new hybrid resource projects can impact the value of an entire energy portfolio.

We approach the analysis by utilizing PLEXOS to run a fully co-optimized model: co-optimizing generation and transmission along with energy, and auxiliary services in a full gas network and power network model. We then included different levels of solar plus storage to see how the overall portfolio value changes depending on the amount and ratio of energy generation to storage. Finally, all these factors are considered in a sub-hourly analysis to properly account for the variability of solar generation.

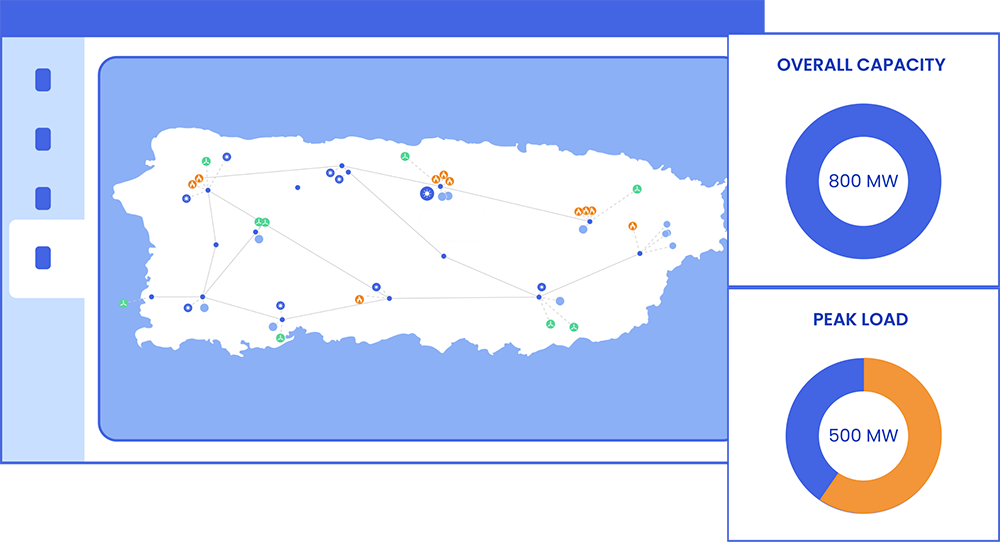

In this scenario, we were modeling a grid with an overall capacity of 800 MW. Peak Load is 500 MW, and since there are already quite a few solar and wind projects on the grid, reserve capacity has its challenges. Overall, the load factor is 0.741, which is typical in these types of analysis.

We then ran a total of twelve scenarios looking at the optimal configurations from each previous iteration. Starting with a base case, we began by adding solar generation capacity and then layering in different ratios of storage.

We started with five scenarios looking at solar generation built out on the base case.

Of these five scenarios, Base + 150 MW Solar showed the greatest return on investment. For the next iteration, we ran three additional scenarios that layer in battery storage.

Base + 150MW Solar +80 MW Battery Capacity showed itself to be the most optimal project balance. For the final iteration, we added two final dimensions that layer in EV Storage as both non-hybrid projects and hybrid projects where battery storage would only charge when the solar project was generating electricity.

Analyzing the results, we focused on the following factors as most important in weighing the project:

With PLEXOS we are able to determine that a solar project with 150 MW capacity, 80 MW of battery storage, and 3.2 MWh of EV capacity provides the most value across the relevant factors for the model being considered. In general, a hybrid project that includes about 50% of storage capacity (from the Renewable capacity), and additional mobile storage (i.e. electric transportation) provides the highest value to the system across multiple market commodities and services.