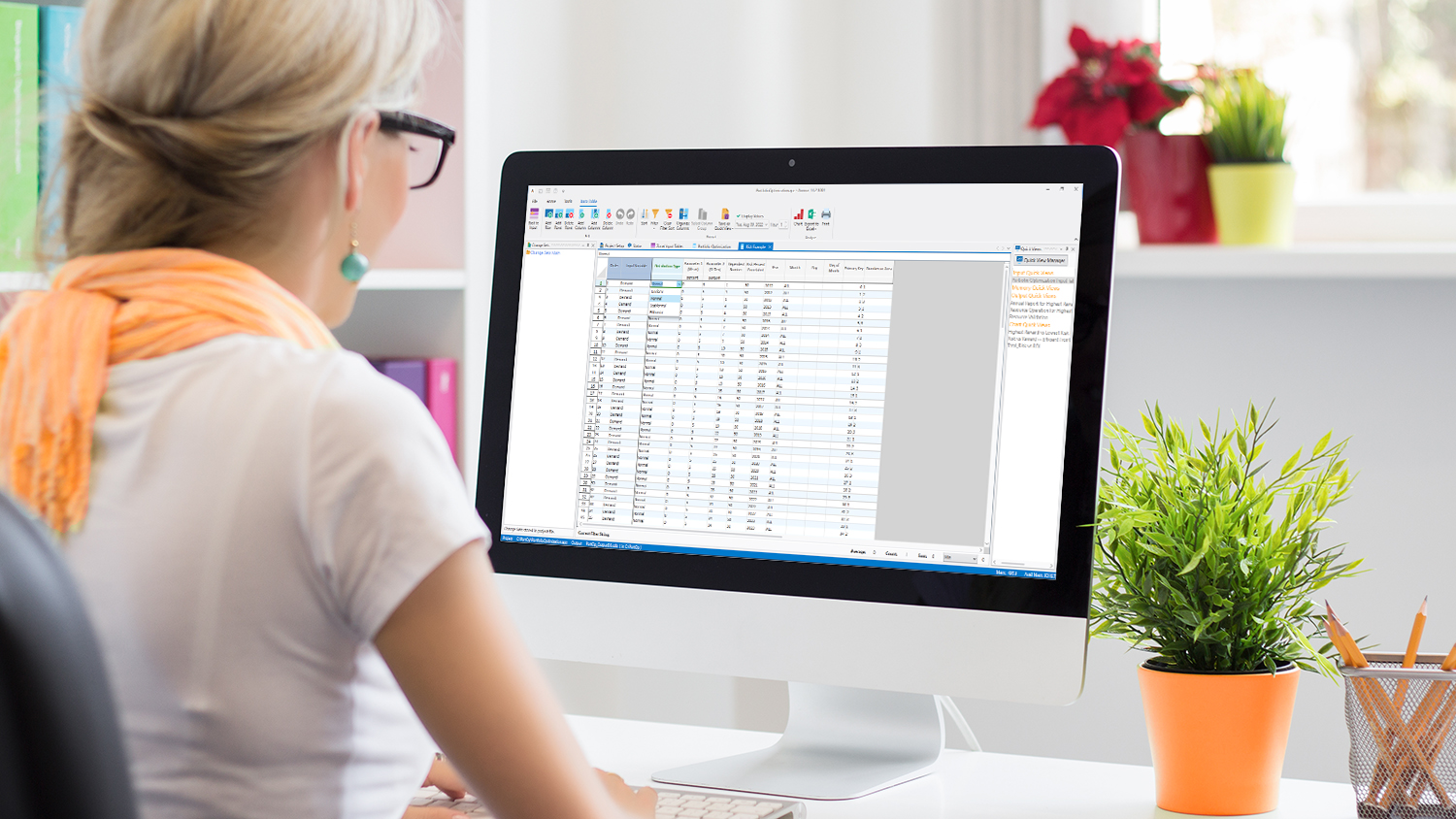

Easily Integrate with Existing Workflows

Capabilities such as linking with Excel, importing from other databases, scripting to automate data entry, and computational data sets (CDS to automate pre- or post-processes) all enable easy integration with any process. Integrations further include web-based data sources and other subscription services.

-1.png?width=854&height=504&name=Energy%20Exemplar%20Logo%20Black%20(2)-1.png)