Modelling the feasibility of utility scale electrolysis in the Nordics

Flexens - a project development organisation with a mission to transition an industry Flexens is a project development company based in Finland....

4 min read

Team Energy Exemplar

:

August 8, 2023

Team Energy Exemplar

:

August 8, 2023

Ren-Gas is a Finland-based clean energy project developer. The company invests in the best power-to-X (P2X) gas production and distribution sites in the country. Ren-Gas’ projects and actions enable cost-effective emission reductions in the transportation and energy sectors, increased energy independence, and a platform for significant industrial investments in Finland.

Hydrogen will be a critical component of the energy transition. However, because it is an emerging technology, it is unclear how hydrogen production will impact power systems and markets. As a P2X project developer, Ren-Gas needs to understand how hydrogen will impact the Nordic electricity market prices.

However, understanding the impact of hydrogen production isn’t as straightforward as one might think. Renewable penetration is increasing all over the world, as is electrification. As a result, we’re seeing an increase in variable generation alongside an increase in electric demand, both of which impact pricing. Electrolysers will also consume electricity, which will further impact pricing and market dynamics. When seeking to understand what the future will look like, Ren-Gas, and many others, are trying to answer questions about technologies and resources that are not yet present in the electricity market.

Due to the complex dynamics of the systems, and the hypothetical nature of the questions Ren-Gas needs to answer, it was determined that a fundamental model would be best suited to the company’s needs. PLEXOS offers the gold standard of fundamental modeling in energy and adjacent industries. For this reason, Ren-Gas chose PLEXOS for their fundamental modeling needs. The modeling team used the Northern European electric dataset as a starting point for their fundamental model.

The Ren-Gas model, using Energy Exemplar’s Northern European electric dataset as a base, covers 15 bidding zones, detailed generation fleets, demands and interconnections, several weather years, and models connections to Central Europe. With the model, Ren-Gas wanted to capture the elements that impact price variability the most. The four elements that the company felt needed to be modeled accurately to adequately capture price variability were variable renewable generation profiles, water values, bidding, and line congestion.

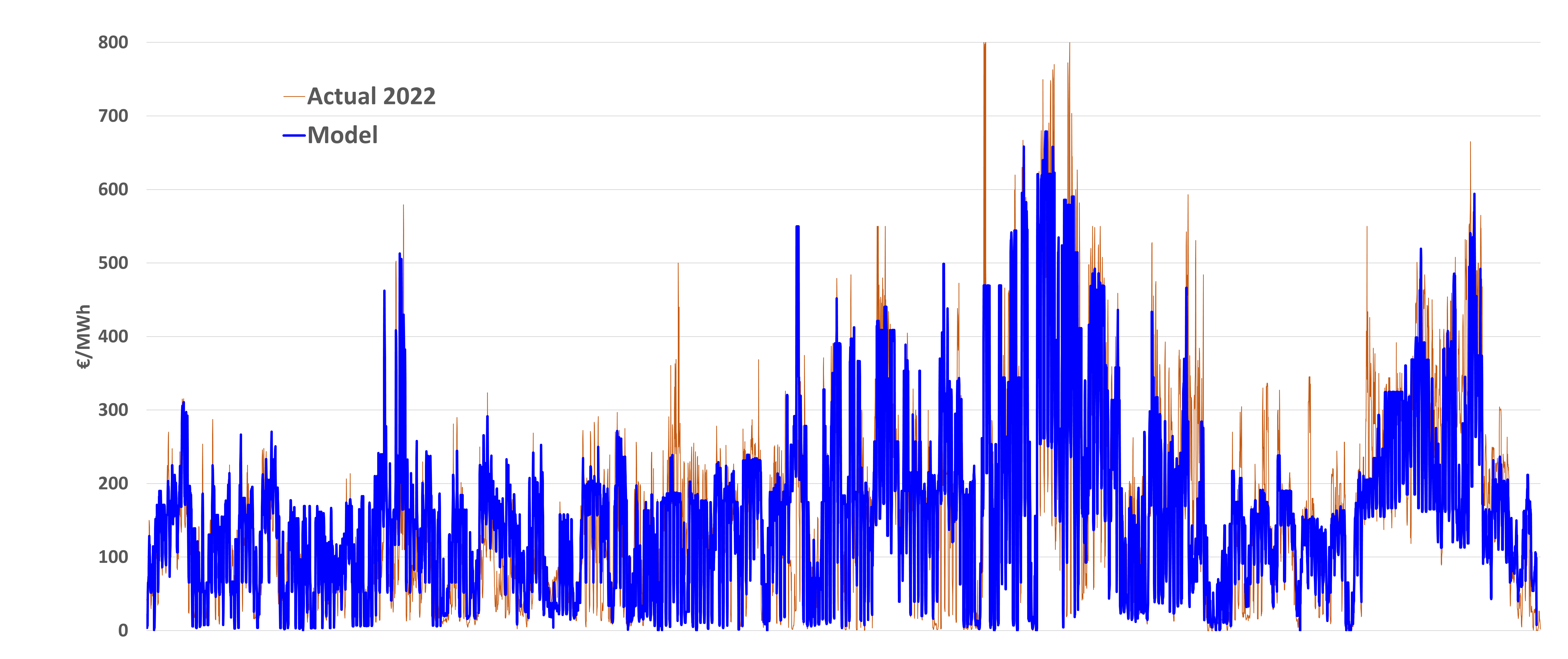

The team at Ren-Gas initially ran the model for 2022. Using basic settings, the model came back with quite flat results, looking specifically at price level, volatility, and renewable cannibalisation. With these results, the team did some further calibration. With calibration, the team was able to get the model to capture average prices and variability seen in 2022. As far as the model calibration went, they were careful not to fix too many elements in the model, such as power plant outages. This was done so as to keep the model generic, so that it mimics a variety of years, and more accurately models future scenarios.

Ultimately, with calibration, the team was able to get quite close to the 2022 actuals - the results for the Finnish price are in the figure that compares the modelled price with the actual 2022 price. They were very pleased with this because 2022 had so much unexpected volatility that it’s a very difficult year to model, but with PLEXOS and the Energy Exemplar dataset, they got very close, and created a model that can be used to answer questions about the future. The generic model was also able to quite closely match the actuals of other tested years from 2018 to 2021. Once again, achieving this with a generic model was extremely important because the ultimate goal is to use the model to capture price levels and volatility as they could be in the future.

With the model calibrated, it was time to test some ‘what if’ scenarios. In April this year, Olkiluoto 3 (OL3), Europe’s largest nuclear reactor located in Finland, finally started commercial operation after a delay of over a decade. The team wanted to see what would have happened if OL3 had come online a year earlier. What they found, was that if OL3 had been online in 2022, and the country had 5 GW of wind generation, prices would have been 55% lower than they were – coming in at €69/ MWh instead of €154/ MWh. Interestingly, adding OL3 a year earlier would have also increased the wind cannibalisation level.

While there is much speculation about what prices will look like in the future with the introduction of OL3, Matti Rautkivi, Head of Market Development at Ren-Gas notes, with PLEXOS, speculation is no longer necessary. With the model calibrated so well for 2022, there is a high degree of confidence that this fundamental modeling actually works.

Armed with confidence in the model, it was time to use it for what it was really built for – planning for the future. The team at Ren-Gas modeled three different scenarios for 2030 that will help shape future investment decisions in the country.

The first scenario run with the model assumed only a little additional demand but ambitious renewable additions as on the European 2022 Resource Adequacy Assessment. This provided the following inputs to the model for Finland: ~90 TWh of load, 15 GW of wind capacity, and 2 GW of solar capacity. The weather year of 2022 was used in the simulations. The model showed that in this scenario, the Finnish electricity prices would come in at €26/ MWh. However, wind generation would cannibalise most of its profit, capturing only a price of €12/ MWh, with a wind capture rate of 48%. In this scenario, there would be an overcapacity of renewable generation in Finland, and more load would be required to continue to attract renewable energy investment.

In the next scenario, the team added another 10 TWh of load to the base scenario to account for ~200.000 tonnes of inflexible hydrogen production. If inflexible hydrogen is added to the system, the wind capture rate increases significantly to 66%. However, the Finnish electricity price also increases significantly to €56/ MWh. These prices are above what may be seen as fair or reasonable in the future.

Lastly, the Ren-Gas team once again added 10TWh of load to the base scenario, but this time modeling for ~200.000 tonnes of flexible hydrogen production. In this scenario, wind capture rates are still much better than in the base scenario, with wind capturing a price of nearly €30/ MWh. The Finnish electricity price however, is much more reasonable at €44/ MWh. The outcome of this scenario is much more of a win-win situation. The capture rate and price of electricity would still be appealing for wind investment, but also reasonable enough for hydrogen production, and the general electric end user.

Now that the model is built and calibrated, the Ren-Gas team has the power to evaluate a variety of scenarios and investment opportunities which will benefit society, and the electricity system as a whole. While no one can exactly predict the future – PLEXOS can get you pretty close. Using this fundamental model the Ren-Gas team has built and calibrated in PLEXOS, they can gain insight into future ‘what if’ scenarios that will allow them to invest with a high-degree of confidence, providing value to Finland all the while.

Flexens - a project development organisation with a mission to transition an industry Flexens is a project development company based in Finland....

Organization: Baringa, exploring the key role of hydrogen in the energy transition with PLEXOS Baringa is a management consultancy that covers...

What is (green) ammonia? Ammonia (NH3), recognized for its pungent nature, is indispensable for the production of agricultural fertilizers and...