The Forecasting Tools Traders Trust: Lessons from a European Energy Market Survey

Until recently, European power prices were predictable. That’s because electricity demand was relatively flat, and power generation came primarily...

4 min read

Team Energy Exemplar

:

March 7, 2025

Team Energy Exemplar

:

March 7, 2025

As many traders can attest, the intermittent nature of renewable energy resources has increased the volatility of the European market, driving bi-directional volatility. For example, there has been an uptick in “Dunkelflaute” events in recent months — periods when weather conditions severely limited wind or solar power generation across the continent. When such a large percentage of the stack (renewables) are not operating, the market is forced to use less efficient and expensive plants. This causes prices to skyrocket. On the flip side, the region also saw a record number of periods last year where an overabundance of renewable generation drove energy prices into negative territory in the middle of the day.

Both these scenarios make it very difficult for energy traders to predict energy prices — and the risk of mispricing can have significant financial costs. With the increasing penetration of utility-scale renewable energy sources, it is more important than ever that energy traders have the solutions they need to generate accurate price forecasts.

In this article, we’ll explore the differences between statistical and fundamental models and explain how the flexibility of a fundamental model, such as PLEXOS® for Traders, delivers a superior price forecast over statistical models.

The energy sector utilizes various modeling techniques to analyze energy markets, forecast prices, assess risks and make strategic decisions. When it comes to price forecasting, most choose between statistical or fundamental models. However, in markets with a high penetration of renewable generation, the capabilities of a fundamental model deliver a much more accurate forecast. Let’s compare the two to understand why.

To predict future prices, statistical models analyze historic data such as actual prices, previous weather conditions, and many other data points. This analysis identifies patterns, trends and relationships that inform the model’s forecast. While this type of time series study works well if markets maintain a status quo, i.e. the future is highly similar to the past, it tends to fall apart if a market does something it’s never done before, because it has no way to address unpredictability.

Renewables are inherently intermittent because they’re reliant on the weather. Generation output is directly linked to the amount of sun or wind available at any given point in a day, making these resources far less predictable than fossil fuel-powered plants. As a result, price forecasting with renewables in the mix is much more complicated.

Additionally, the increasing adoption of other non-traditional resources, such as utility-scale battery energy storage systems, virtual power plants (VPP) and bidirectional EVs that can both draw power from and supply power to the grid, create issues with models focused exclusively on historical data. These new technologies are being added at a rapid pace, but because they are new, there is no historical data for statistical models to analyze. That means statistical models cannot account for their impact on price.

The number of interconnections in European markets adds more complexity; with so many connections between countries, it can become too complicated for machine learning to understand. These complications make it even harder for a statistical model to predict prices. Moreover, a statistical model will rarely (if ever) predict a price lower than the lowest historical price — which means a statistical model would not have been able to predict that prices in Europe would hit negative territory, as they did in 2024.

The bottom line is that relying on statistical models to forecast prices in markets with a significant penetration of renewables is risky. Your model could generate an incorrect price, significantly impacting your bottom line.

Check out this video to learn more about how Dunkelflaute impacts energy traders, and how they can prepare for success during these events.

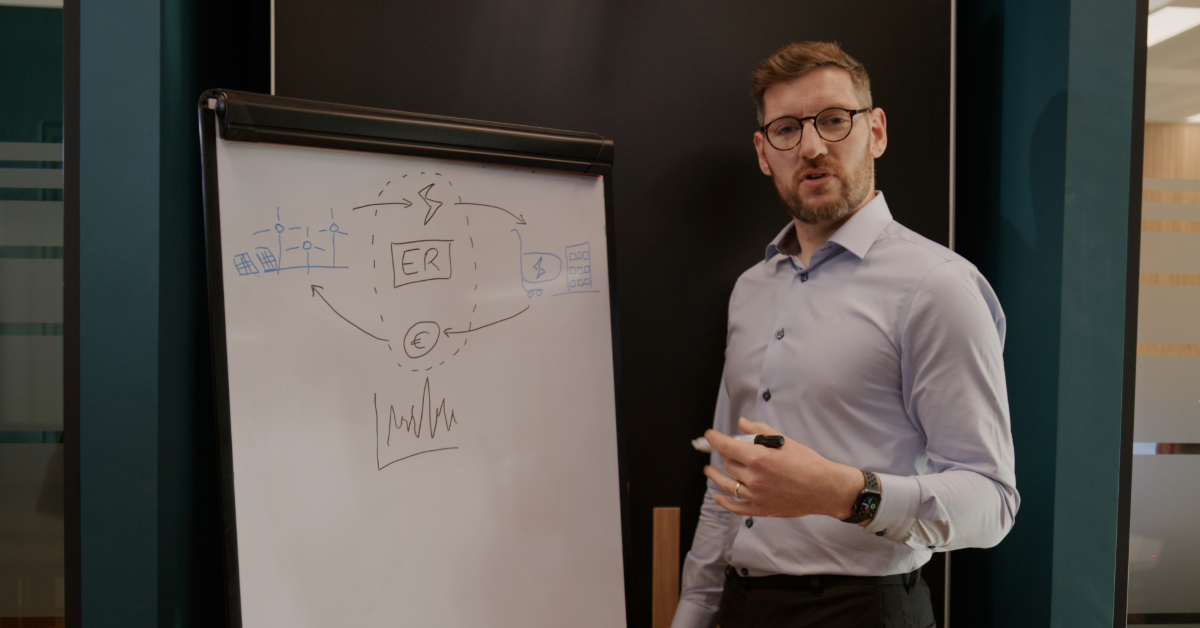

Rather than relying solely on historical data, fundamental models work to theoretically solve the problem of where supply meets demand. Solutions such as PLEXOS® Insights for Traders leverage approximately 20 million rows of data from thousands of generating units across Europe. The model considers generator startup costs, short-run marginal costs, availability, outages, market constraints, power flow between markets, wind generation, solar generation, fuel prices and market structure.

Fundamental models allow the user to understand how price forecasts are derived, as analysts can see exactly which unit is setting the price. For example, last summer, there were many hours where forecasts were hitting -100€/ MWhr. With PLEXOS® for Traders, users can see exactly which asset type or unit is setting these extreme prices.

As a result, traders using fundamental models produce more accurate price forecasts than those using statistical models.

Building a fundamental model is difficult and time-consuming. It needs to be fed a large amount of data and constantly maintained. To save energy traders time and ensure they have the strategic insights needed to stay ahead of the curve, Energy Exemplar offers three robust fundamental model-based solutions.

PLEXOS® Insights for Traders is a fully calibrated fundamental model for key European markets. Ready to go and out-of-the-box, this solution features an easy-to-use API and an intuitive dashboard. There’s no need to build or download anything. PLEXOS® Insights for Traders delivers the price forecast and full fundamental model including all assumptions every morning. This solution is ideal for those who want to get started quickly, and don’t have the time to build a model from scratch.

Interested in gaining an edge in your trading? Check out this case study to learn how InterGen used PLEXOS® Insights for Traders to do just that.

The PLEXOS® Playbook for Traders solution offers the same insights and simulation as the Insights product, but with increased functionality. With the Playbook, traders can make changes to the model’s assumptions if they want to add their own expertise or unique view of the market. In other words, traders can create a bespoke price forecast (or forecasts) based on Energy Exemplar’s model but adjusted for their preferences and understanding of the market.

This solution is very powerful for speculative traders, hedgers and portfolio optimizers alike, as traders get access to a daily updated fundamental model combined with the trader’s own proprietary view. The model can also be refreshed throughout the day as desired, with significant simulation power leveraging Energy Exemplar’s Cloud framework.

PLEXOS® for Traders is a good solution for large firms or those looking for a fully customizable solution. With PLEXOS® for Traders, traders populate the PLEXOS engine with their own data, building everything from scratch and creating a completely bespoke solution.

Until recently, European power prices were predictable. That’s because electricity demand was relatively flat, and power generation came primarily...

The electricity grid is undergoing a significant transformation across Europe thanks to the growing number of renewable generation resources and the...

1 min read

The global shift toward renewables is reshaping the energy system, bringing new levels of complexity, uncertainty, and interconnection. Prices...