European Hydrogen Storage: Key to Enhancing Energy System Adequacy and Security in PLEXOS

This blog is part of a series on hydrogen in PLEXOS, following our discussion on hydrogen transport modelling, which can be found here.

5 min read

Tracey Granger, Evgeniia Kirillova, Evgeniya Mezentseva & Paolo Farina : Jan 16, 2024 9:38:56 AM

Hydrogen is increasingly regarded as a pivotal component in expediting the transition towards a sustainable energy future, particularly in Europe. Over the past few years, the energy and commodity markets landscape has been in a perpetual state of “black swan” events (unpredictable and rare events with significant consequences), pivoting to deal with a series of unforeseen circumstances - energy security issues, uncertainty of supply sources, emerging intermittent generation technologies (energy sources that are not continuously available, like solar and wind power that depend on weather conditions), volatility in commodity prices and combined with concerns around emissions from fossil fuels. This has heightened the interest in alternative, low-carbon supply sources, and made hydrogen a focal point of discussions. Recent policy announcements designed to speed up the transition to a cleaner energy future now include significant hydrogen targets and incentives. As a result, despite being in the early stages of development, hydrogen modelling must now be included in future energy analysis.

Market uncertainty of this magnitude highlights the need for energy market participants and key stakeholders to proactively experiment with potential future energy mix scenarios and develop stress scenarios to envision potential future outcomes. Traditional energy models and modelling methodologies, which often separate or oversimplify hydrogen and electricity models, may struggle to adapt and remain relevant in this complex environment. In this context, PLEXOS serves as a powerful cross-commodity modelling tool, helping analysts and energy experts to formulate future energy balances aligned with climate objectives and the future energy mix. It serves as a crucial instrument for navigating the intricate landscape of evolving energy dynamics.

As we turn our focus to the specifics of hydrogen's role in the energy market, it's essential to explore how PLEXOS uniquely models the economic aspects of hydrogen and integrates it with existing electricity markets. While PLEXOS fundamental electricity models are well established, modelling the economics of hydrogen is a relatively new concept. Despite this, PLEXOS provides “out-of-the-box” functionality for modelling the characteristics of hydrogen (and other gaseous commodities) and, crucially, the linkages between these gaseous markets and electricity markets. To enable PLEXOS users to perform hydrogen analysis successfully, Energy Exemplar has launched a European Hydrogen Dataset - a large-scale, detailed PLEXOS Dataset covering the fundamentals of the European hydrogen market. This comprehensive dataset offers supply/demand balance and robust price and volume projection for hydrogen. It is designed to operate either as a standalone hydrogen model or it can be linked with PLEXOS electricity and/or gas datasets.

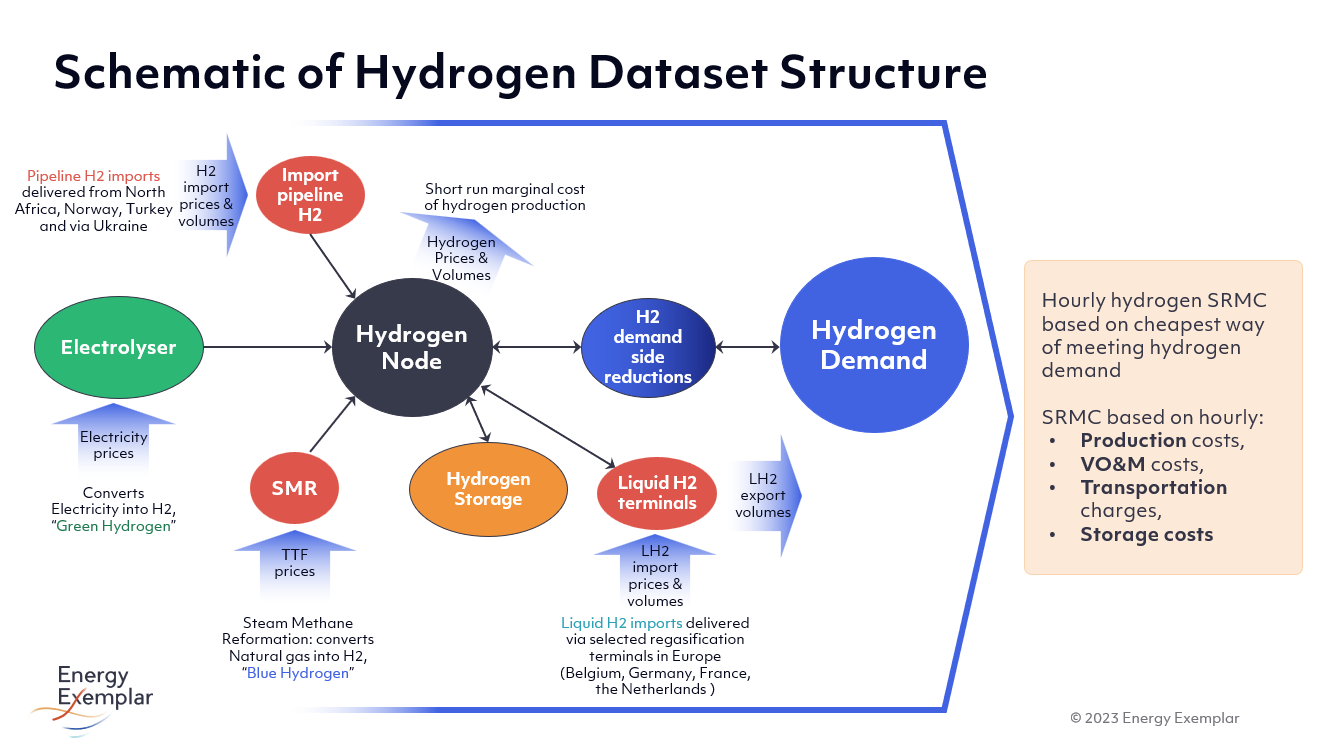

Schematic of the European Hydrogen Dataset for PLEXOS

The European Hydrogen dataset aims to enable PLEXOS customers to gain a deeper understanding of both the opportunities and challenges that lie ahead in the emerging hydrogen market. A close examination of the latest modelling results provides valuable insight into the future trajectory of this dynamic sector.

The European Commission’s REPowerEU Plan includes an objective of 10 Mt domestic green hydrogen production and 10 Mt hydrogen import for Europe. ENTSOE and ENTSO-G’s TYNDP scenarios incorporate this objective into their analysis, and the PLEXOS European Hydrogen Dataset incorporates these assumptions to show how hydrogen drives the decarbonisation of the energy system towards the net zero 2050 goal.

The European Hydrogen Dataset models both indigenous green hydrogen (hydrogen produced through the electrolysis of water using renewable energy sources like wind or solar power) and blue hydrogen production facilities (hydrogen produced from natural gas through steam methane reforming, with carbon emissions being captured and stored) by country via Power-to-X and Gas Plant objects - representing electrolysers and steam methane reforming facilities respectively. While hydrogen production technologies are well known and utilised to meet current demands in petrochemical production, refining and as a feedstock for ammonia in the fertiliser production, in the energy industry there are currently no examples of large-scale hydrogen production where fossil fuels are used in a high-consumption, low-emission way. However, the best known and most popular technology for the production of green hydrogen, alkaline hydrogen production, is mature enough for large-scale pilot production units, and costs and processes are well understood. Blue hydrogen production facilities, in the form of steam methane reformation, are also well established, although carbon mitigation strategies limit unabated blue hydrogen production. The European Hydrogen Dataset includes details of current and projected future hydrogen production facilities for both green and blue hydrogen.

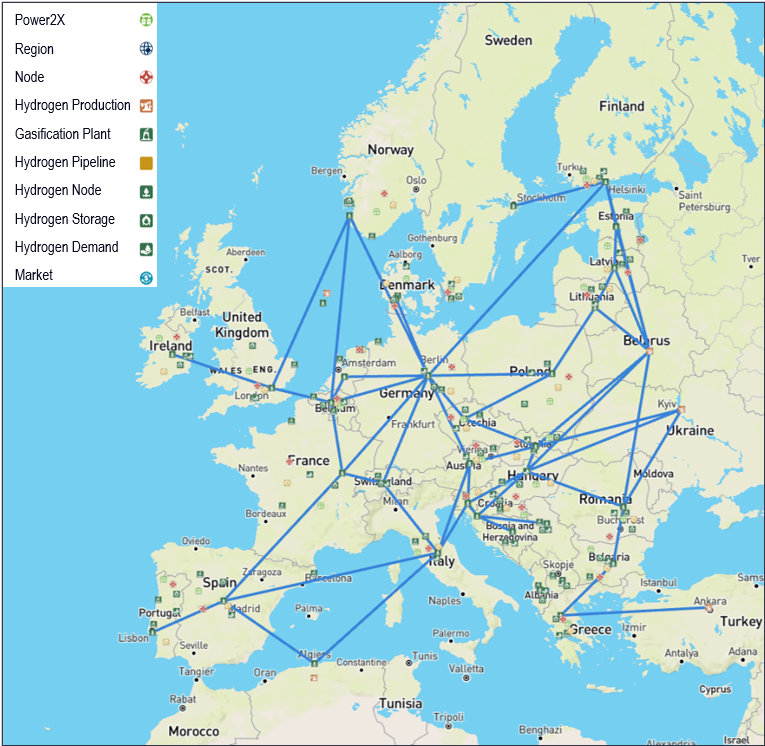

Despite production technology not being a major barrier to meeting hydrogen production goals, a lack of transport and storage infrastructure is a major issue. The European Hydrogen Dataset enables detailed analysis of hydrogen transportation and storage capacity and energy requirements through the incorporation of hydrogen infrastructure to link hydrogen “hubs”, based on a combination of re-purposed and new hydrogen pipelines. The European Hydrogen Dataset also includes potential world trade of hydrogen, through pipeline imports and liquid hydrogen (LH2) imports and exports delivered via liquid hydrogen regasification terminals in Europe.

PLEXOS European Hydrogen Dataset (Source: PLEXOS Cloud)

While hydrogen is regarded as a tool to help meet climate change goals announced across continents, costs are often perceived to be prohibitive and remain a barrier to large scale green hydrogen production. Although we are in the very early stages of market development, once transport and storage infrastructure plans are realised and targets are met, we expect today’s nascent hydrogen market to mature and form into a tradeable, liquid commodity by 2035-2040s. In this timeframe, it is anticipated that hydrogen-fuelled electricity generation will be a significant part of the electricity market, and thus hydrogen price becomes a driver of electricity prices.

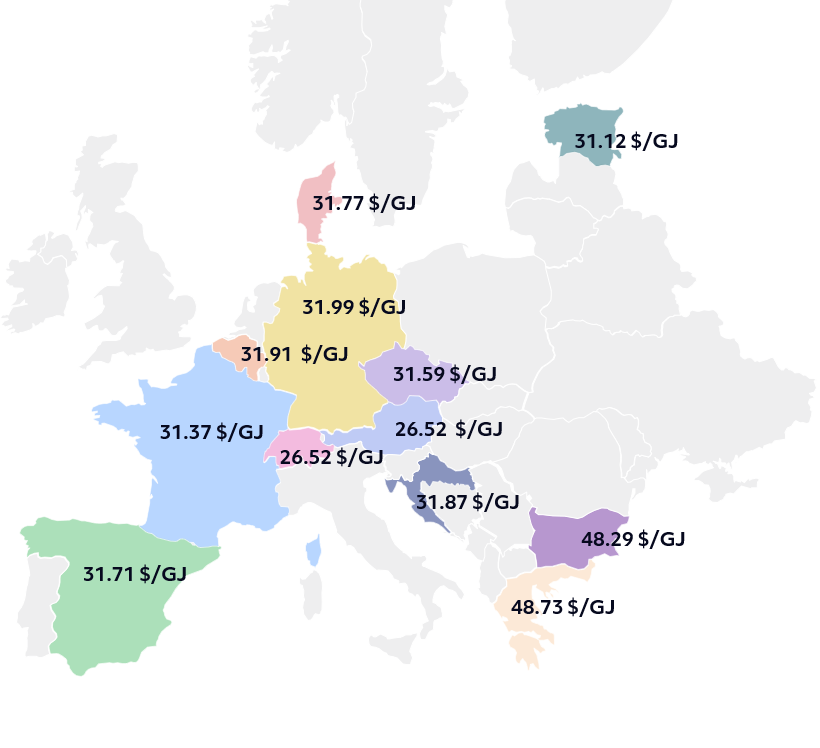

According to the IEA, low-cost hydrogen can be produced in many geographies across the globe. Depending on the region, solar power, wind power or a combination of both can be used to produce cheap low-carbon hydrogen. Hydrogen transportation and storage enables a global supply/demand balanced hydrogen market to be developed.

Example of forecasted Average Hydrogen prices for April 2035 from the PLEXOS European Hydrogen Dataset

The Hydrogen Dataset forecasts future hydrogen prices across Europe, driven by the hourly short run marginal cost of production of hydrogen from each supply source, calculated by PLEXOS. This bottom-up approach provides values to back the hourly decision of how to meet hydrogen demand: by blue or green hydrogen production; from piped imports; by using hydrogen storage; or through import or export of liquid hydrogen. The resulting hydrogen price incorporates the chronological and seasonal characteristics and costs of each supply source and takes transportation and storage costs into account.

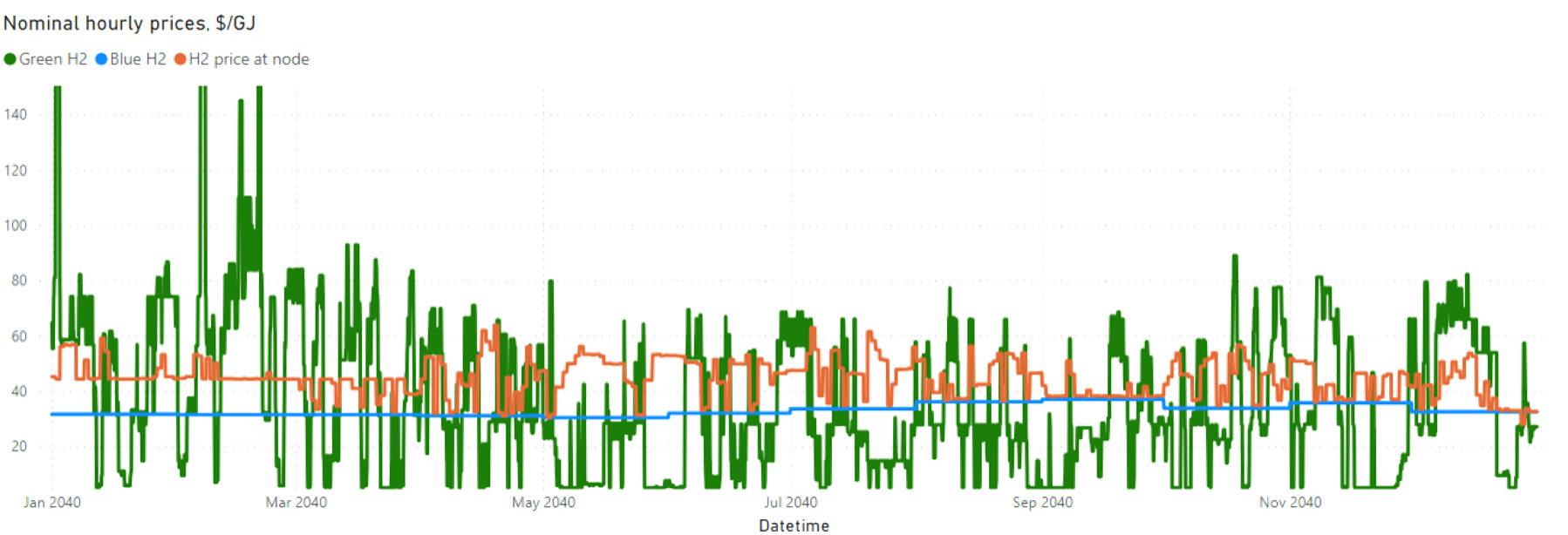

Example of forecasted Hourly Hydrogen Prices for 2040 from the PLEXOS European Hydrogen Dataset

As the graph shows, hydrogen price volatility is expected to be significant as green hydrogen operating costs are driven by even more volatile hourly electricity prices, while blue hydrogen costs are driven by daily gas prices. Gaining an understanding of the future hydrogen price shape and merit order cost stack is important as hydrogen becomes a driver of marginal electricity prices.

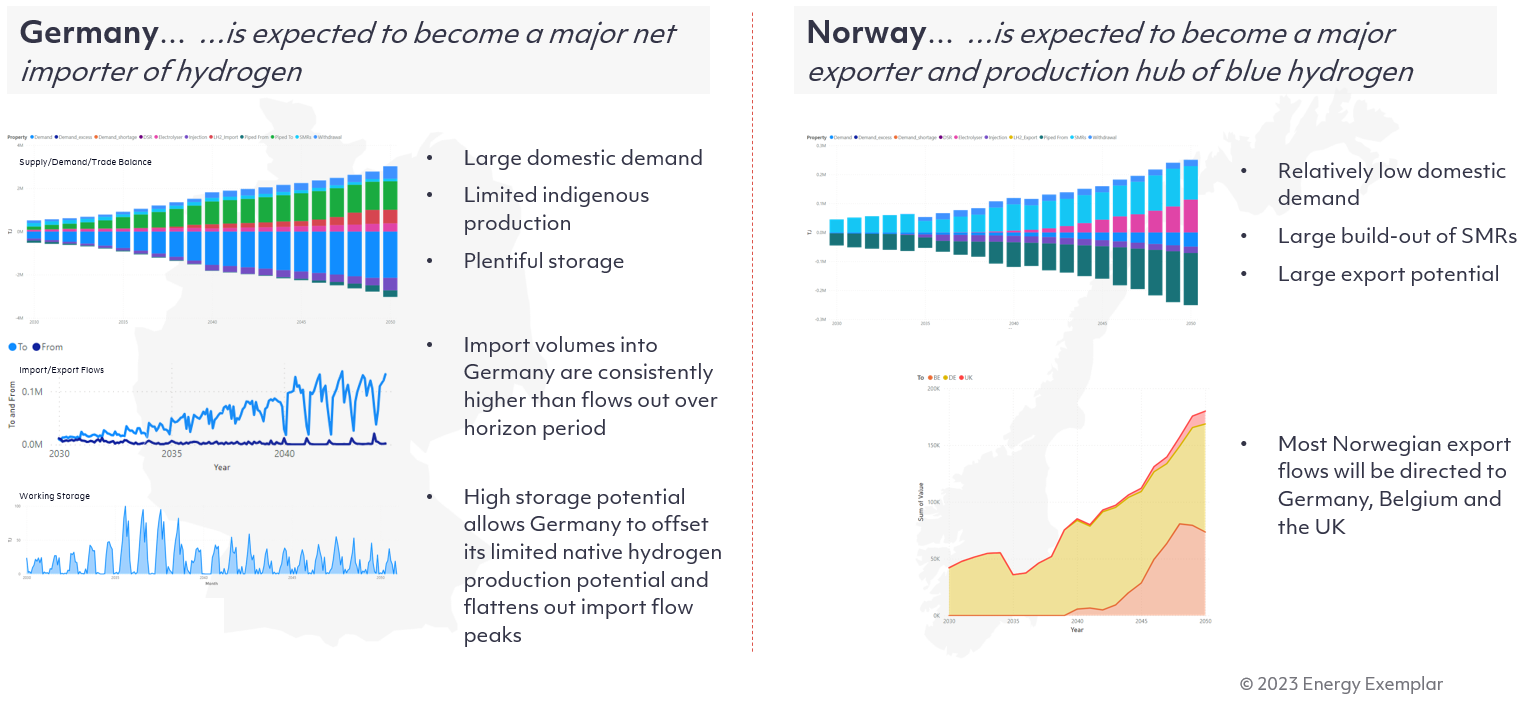

The European Hydrogen Dataset reveals a picture of each country’s hydrogen development path, and multiple scenarios and sensitivities can be developed. As hydrogen emerges as a significant part of the energy mix, gaining this understanding of the key drivers of the hydrogen market, their impact and interrelationships, help navigate the uncertainty of the energy transition.

Hydrogen is poised to significantly influence the shaping of a sustainable energy future. The PLEXOS European Hydrogen Dataset offers a comprehensive tool for modelling and understanding the hydrogen market. As we anticipate the growing integration of hydrogen in our energy systems, it's vital to recognize the challenges and opportunities it presents. Whether it's in terms of production, infrastructure, costs, or market pricing, hydrogen is poised to play a critical role in the global pursuit of decarbonization and energy security. By staying informed and adapting to these emerging trends, modellers can make strategic decisions that align with the evolving energy landscape.

To delve deeper into the world of hydrogen energy and its impact on the global energy transition, we invite you to join our exclusive webinar on January 24, 2024. This session will provide you with further insights into the PLEXOS European Hydrogen Dataset, and our experts will be there to answer your queries. Don't miss this opportunity to enhance your understanding and stay ahead in the energy sector. Sign up here to secure your spot in the webinar.

This blog is part of a series on hydrogen in PLEXOS, following our discussion on hydrogen transport modelling, which can be found here.

This blog is part of a series on our co-optimization models in PLEXOS, following our discussion on Embracing the Energy Transition with PLEXOS...